Decision Support Tools

We help you to take wise decisions and guide you through the entire journey.

Housing Affordability Planning Tool

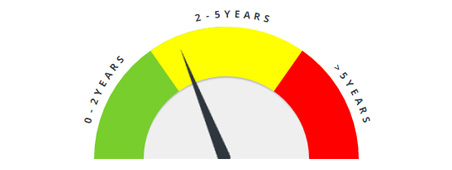

Planning to buy a property in

future?

Find when can you afford your first/next property?

The price of the property you desire now may keep rising. So, your savings & loan budget need to be projected in conjunction with property rise to arrive at your month of affordability.

Buying Affordability

tool

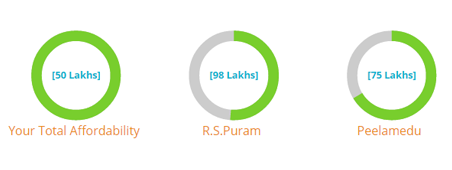

Looking to buy a Property now?

Find what can you afford & where you can buy?

One needs to walk a million yards before owning his dream home. Lets get started with the first step in your journey by knowing your affordability and the localities where your requirement and affordability matches.

Instant Home Loan Preapproval

Tool

Need Home Loan before finalising the property?

Find multiple Pre-Approved Home Loan offers

Its better to take a written Loan offer from the Bank before finalising a Property. We help you get home loan Preapproval with best rates and higher Loan eligibility. You get the freedom to choose your property without the worry of whether I can afford this Property.

Multi Portal Property Search Tool

Are you searching for

properties now?

You dont need to visit multiple portals and do search again and again. We aggregate property data from all renowned property portals in india at one go !

Assisted Property Search Services

Want help in identifying the right Property Broker?

We help you to work with multiple Brokers at one go.

We share your requirement with all our partner Brokers. Propwiser customer care will filter and suggest properties from our partner Brokers that matches your requirement. All this at no extra cost other than standard brokerage charges.

Home Loan Recommendation Tool

Know the best Home Loan option for your profile?

Find the best Home Loan offers that matches your requirement

Once you have chosen a property, Narrowing down on the right home loan without wasting money on processing fees is an uphill task. We help you to find whether you get the best rate or higher loan amount or flexibility in own contribution timing or consumer friendly process.

Legal Document checklist Tool

Confused over documents to be collected?

Find the documents required to buy a property

Availability of documents make or breaks a deal. We help you to be in control on these.

TDS Guidance Tool

Are you aware that TDS has to be filed by Buyer?

Get Concise guidance in

filing TDS

Its onus of the Buyer to deduct TDS from the Seller while the Property price is over Rs 50 laks and pay on time to Government to avoid penalties. Let us help you with that. How TDS has to be filed varies by number of Buyers and Sellers involved in the transaction & by Resident status of the parties involved

Resale Tracker Mobile App(Coming Soon)

Are you about to buy a resale property?

We help you to get all the transacting parties in the same page

In a resale Transaction, there are Buyer, Co Buyer, Buyer Broker, Seller, Co Seller, Seller Broker, Buyer Lawyer, Buyer Bank, Seller Lawyer, Seller Bank etc. The crux of the transaction is in knowing who has to do what and track if they have done that task. Resale Tracker app helps you invite, collaborate & track.

Loan Against Property

Looking for loan for your personal/business needs?

Leverage your existing property and avail loan to your needs

With the help of this tool you will be able to get multiple loan offers against your property. Compare and choose the best offer. You can use it for various purposes like personal/business/marriage/education .

Balance Transfer Tool

Are you paying higher interest rate?

Find lower interest rates prevailing in the market

If you have the pain of paying higher interest rates, this tool helps you to find Banks with lower interest rates and allows you to transfer outstanding balance from the current Bank.

Tax savings on your Portfolio

Do you own one or more properties?

Find overall tax savings from your property ownership

If you own one or more properties and if they are on home loan, there are tax benefits out of it. This tool helps you to calculate your tax savings by calculating the difference between your tax liability without considering and with considering the property ownership.

Assisted Selling Services

Need Broker to sell your property?

Sell through Multiple Brokers at one go.

Identifying the Right Broker to promote your property for sale and getting it sold on right price & time is the key. We help you in reaching out to multiple Brokers in your locality & close the deal on time at same brokerage cost.

Multi Portal Property Search Tool

Are you search for properties to Rentin?

Search all Property portals at

one go.

You don't need to visit multiple portals and do search again and again. We aggregate property data from all renowned property portals in india at one go!

Assisted Rentout Services

Need Broker to rent out your property?

Promote it through Multiple Brokers at one go.

Identifying the Right Broker to promote your property and getting right kind of tenant timely is the key. We help you in reaching out to multiple Brokers in your locality & close the deal on time at same brokerage cost.

Rental Management App

Unable to track & manage your rental Relationship?

Manage your Rental relationship from your Mobile.

Landlord and Tenant have to keep track of token advance payment, security deposit, rental agreement, timely rental payment, receipts for tax filing, utility bill payment, renewal etc. The App helps you with all that.