Decision Support Tools

We help you to take wise decisions and guide you through the entire journey.

For those who have not Identified Property

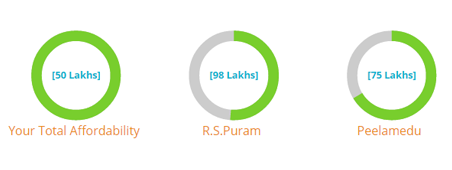

Buying Affordability

tool

Looking to buy a Property now?

Find what can you afford & where you can buy?

One needs to walk a million yards before owning his dream home. Lets get started with the first step in your journey by knowing your affordability and the localities where your requirement and affordability matches.

Instant Home Loan Preapproval

Tool

Need Home Loan before finalising the property?

Find multiple Pre-Approved Home Loan offers

Its better to take a written Loan offer from the Bank before finalising a Property. We help you get home loan Preapproval with best rates and higher Loan eligibility. You get the freedom to choose your property without the worry of whether I can afford this Property.

Multi Portal Property Search Tool

Are you searching for properties now?

You dont need to visit multiple portals and do search again and again. We aggregate property data from all renowned property portals in india at one go !

Assisted Property Search Services

Want help in identifying the right Property Broker?

We help you to work with multiple Brokers at one go.

We share your requirement with all our partner Brokers. Propwiser customer care will filter and suggest properties from our partner Brokers that matches your requirement. All this at no extra cost other than standard brokerage charges.

For those who have Identified Property

Home Loan Recommendation Tool

Know the best Home Loan option for your profile?

Find the best Home Loan offers that matches your requirement

Once you have chosen a property, Narrowing down on the right home loan without wasting money on processing fees is an uphill task. We help you to find whether you get the best rate or higher loan amount or flexibility in own contribution timing or consumer friendly process.

Legal Document checklist Tool

Confused over documents to be collected?

Find the documents required to buy a property

Availability of documents make or breaks a deal. We help you to be in control on these.

TDS Guidance Tool

Are you aware that TDS has to be filed by Buyer?

Get Concise guidance in filing TDS

Its onus of the Buyer to deduct TDS from the Seller while the Property price is over Rs 50 laks and pay on time to Government to avoid penalties. Let us help you with that. How TDS has to be filed varies by number of Buyers and Sellers involved in the transaction & by Resident status of the parties involved

Resale Tracker Mobile App(Coming Soon)

Are you about to buy a resale property?

We help you to get all the transacting parties in the same page

In a resale Transaction, there are Buyer, Co Buyer, Buyer Broker, Seller, Co Seller, Seller Broker, Buyer Lawyer, Buyer Bank, Seller Lawyer, Seller Bank etc. The crux of the transaction is in knowing who has to do what and track if they have done that task. Resale Tracker app helps you invite, collaborate & track.